The ongoing digital transformation of business and society has been shifted into overdrive by the COVID-19 pandemic, triggering major changes in key segments ranging from online services, to capital spending, to the cloud, to the electronics supply chain.

In response to COVID-19, consumers, employees and citizens across all demographics and sectors worldwide are embracing an array of digital activities and technologies throughout their personal and professional lives. This fundamental change is prompting the technology industry to redirect its investments and reconsider its roadmaps, according to Omdia’s latest report, Connecting the Dots: Key strategic opportunities in a post-COVID-19 world.

“The notion that consumers and enterprises will conduct a growing amount of their lives and businesses online is nothing new,” said Clint Wheelock, chief research officer at Omdia. “At a macro level, this is a change that’s been happening gradually over nearly 40 years. However, the scale and scope of the COVID-19 is changing that. With more people necessarily relying on technology to work, shop, and socialize than ever before, the move to adopt next-generation technologies, services and strategies is accelerating at an unprecedented rate.”

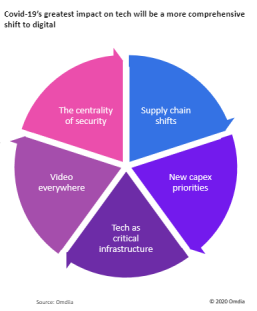

Omdia has identified five interlinked areas where the changes spurred by COVID-19 will cut most deeply across consumer, enterprise, industrial, device, component and service provider markets:

- COVID-19 has weakened several key links in the supply chain but will strengthen others. The smart device market will be hit hard by COVID-19, but the pandemic will have a more nuanced impact on the overall tech supply chain, thanks to rapidly-growing demand for digital services.

- As capital spending patterns change, knowing where new market opportunities are arising will be critical. COVID-19 will present new opportunities amid the overall market gloom in areas such as telecoms infrastructure, remote monitoring, and healthcare.

- The pandemic will trigger a rethink of technology as critical infrastructure. Governments and regulators take steps to bolster domestic infrastructure, paving the way for the expansion and evolution of new and existing forms of “tech nationalism.”

- Video will be everywhere and for everyone. COVID-19 restrictions are prompting more people to watch online video and make video calls than ever before. However, video will also enable an array of other innovative applications for consumers, enterprises and the public sector.

- Harnessing tech to secure both the physical and digital worlds will be more important than ever. Implementation of social distancing and business closures to limit person-to-person contact have significant implications for how and why companies deploy and use security.

Key datapoints in the report include:

- Ventilator revenue in 2020 is set to increase by 71.4 percent to reach $4.6 billion, while patient monitor revenue is expected to rise by 27.4 percent to total $3.8 billion.

- Global governments have announced 186 new policies related to COVID-19.

- Video traffic on the Internet could increase by up to 12 percent this year under extended lockdown conditions.

- Global premium video subscriptions will surpass 1 billion this year.

- Server shipments will rise 8 percent in 2020 as data centers gear up to support digital services.

Supply-chain impacts

Demand for an array of digital services from consumers and employees in enforced lockdown will drive increased investment in the technology to support these offerings, both during and after the pandemic.

Increased demand for data-center servers has resulted in record first-quarter revenue for the market. Omdia anticipates this phenomenon will continue through the first half of 2020 to facilitate the provision of digital services, but a weaker second half due to worsening enterprise IT spend. For the entire year of 2020, Omdia anticipates the server market will grow by 8 percent on a unit basis. This represents a 5 percent upward revision compared to Omdia’s previous growth forecast.

Growing demand for digital services will be reflected in other parts of the technology supply chain. Omdia forecasts that semiconductor revenue will pass $120 billion in the fourth quarter of 2020, up 9.7 percent year-on-year. Inventory levels of memory chips have been lean this year, due to demand from hyperscale datacenters, but also because of strong PC sales driven by work-from-home and online-education mandates.

The supply of silicon, chemicals and manufacturing consumables involved has also been impacted minimally by COVID-19. Chemical and material suppliers are anticipating only a minor slowdown in demand during the first half of 2020. A modest recovery is forecast throughout the second half of 2020 and beyond as manufacturing companies ramp facilities to accommodate a rebound in demand during the third and fourth quarters. The long-term outlook remains strong, with 5G, datacenter servers and other next-generation technologies driving increased demand for materials used in chip manufacturing.