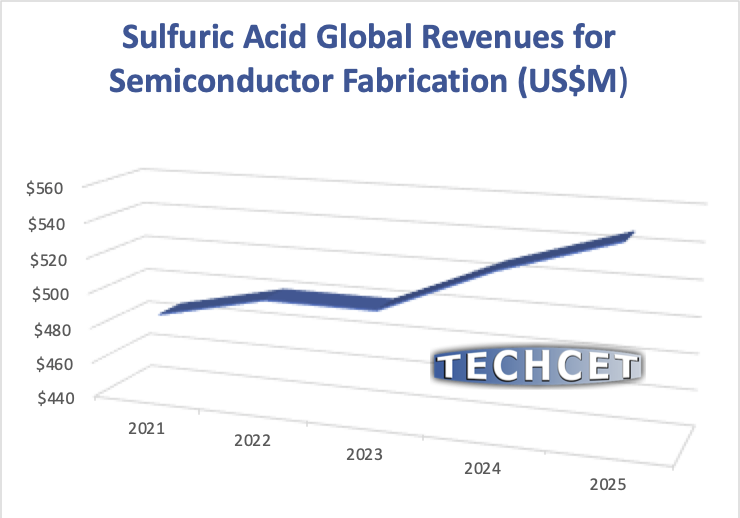

TECHCET—the electronic materials advisory firm providing business and technology information—announces that the global market for semiconductor-grade sulfuric acid (H2SO4) is steadily growing at ~US$500M per year (Figure), within a total wet chemicals and specialty-cleaning solutions market of just over US$2B in 2021. Although wet chemicals revenue growth averages ~3% in any typical year, volume demand is anticipated to exceed 5% CAGR (2021-2025), with a spike in demand in 2023. Sulfuric acid is critical for cleaning and for etching in semiconductor fabrication (fab) lines, yet regional shifts in demand may create shortages unless strategic investments are made now.

Compared to relatively lax “electronic grade” chemicals, for a material to be qualified for manufacturing in a leading IC fab it typically needs to meet parts-per-trillion (ppt) specifications. Ultra-pure materials require special purification, packaging, and shipping technologies. Fabs for the most advanced logic nodes are increasing the number of cleaning steps and corresponding chemical demand by 25-30%, often while needing to tighten the purity requirements.

Leading international IC foundries TSMC and Samsung have announced plans to increase advanced fab capacities in the US, so each company has to consider how best to extend their existing supply-chains. Materials companies that have already made the investments in people and technology to earn getting qualified as suppliers to advanced IC fabs have advantages in setting up in new regions regardless of the home country.

Semiconductor-grade wet chemical supply in the US and Europe are currently tight such that fab expansions would cause local shortages unless capacity investments are made. This is especially true in the US where shortages are expected for sulfuric acid, and other critical wet chemicals, as will be detailed in a special report now being compiled by TECHCET. For more information on the impact of fab capacity expansions on the US wet chemical suppy-demand balance, please contact TECHCET at cmcinfo@techcet.com.