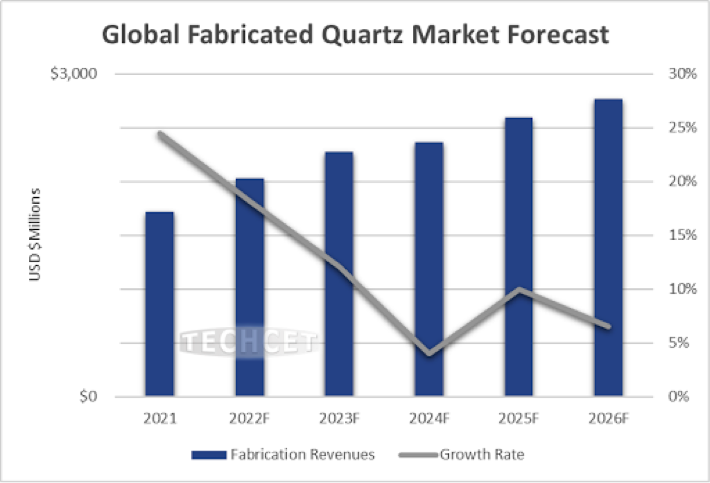

TECHCET—the electronic materials advisory firm providing business and technology information— announced the 2021 worldwide market for fabricated quartz parts reached US$1,718 million, growing 25% above 2020, with segments of the market in Taiwan and Korea growing over 30%. The global fabricated quartz parts market will expand another 18% in 2022.

As outlined in TECHCET’s newly released report on the Quartz Materials, fabricated quartz components supply is out of balance with demand and strained given the hot market conditions that started in 2021 that are continuing into 2022. The supply chain continues to adapt and work through production and logistic issues; however TECHCET observes backlogs and extended lead-times for these products.

“Production issues were the norm in 2021 given strong market demand, and issues have remained so far in 2022”, said Kuang-Han Ke, TECHCET’s Senior Analyst covering consumable equipment parts. “Current sentiment is that quartz suppliers are starting to pull in expansion plans scheduled for 2023 into 2022. Expansion plans are starting to happen”.

Like other semiconductor industry supply chain sectors, the fabricators need to address issues with delivery schedules, planning for the acquisition of needed production equipment, and the hiring and training of new personnel.

It is interesting to observe that both fab and QEM customers focused quartz parts sourcing in 2021 towards the major and mid-size fabricators. This trend has contributed to the supply chain strain and delivery backlogs. There are options available for customers to work with and develop smaller suppliers to address supply chain issues, though this approach has some risks.