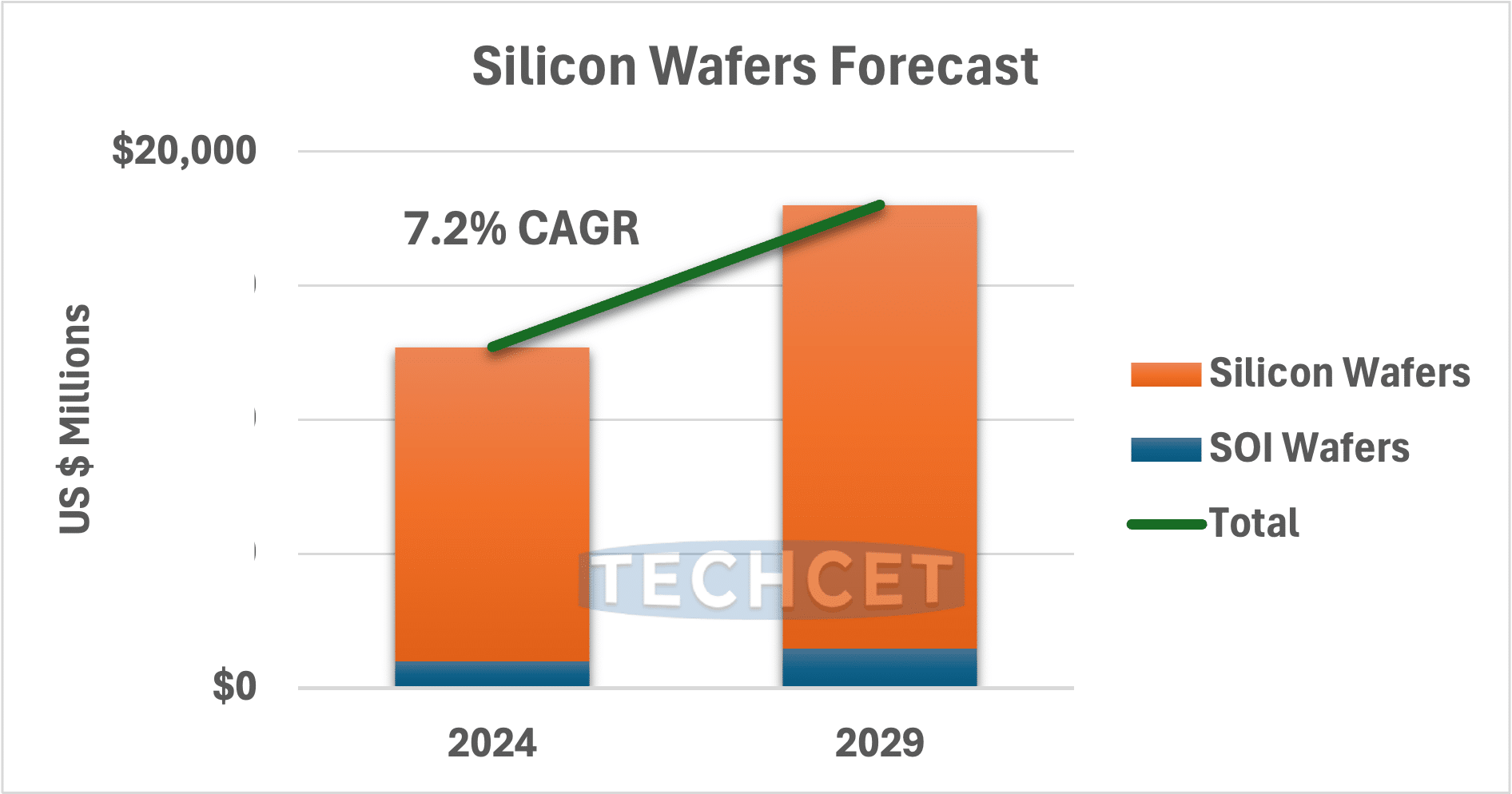

TECHCET — the electronic materials advisory firm providing strategic information on semiconductor materials supply chains — reports that the silicon wafer market is set to rebound in 2025, with shipments forecasted to grow +5.4% to 13,076 million square inches (MSI) and revenues expected to rise +6.7% to US $13.6 billion. This growth will be driven largely by a +7.0% increase in 300mm wafer shipments, supporting expanding demand for AI, HPC, advanced logic, and certain high-performance memory applications, such as HBM. According to TECHCET’s newly released Critical Materials Report™ on Silicon Wafers, the market is projected to sustain steady expansion with a 2024–2029 CAGR of +6.0% for shipments and +7.2% for revenues.

Market momentum is being fueled by strong infrastructure buildouts for AI and datacenters, as well as a shift toward higher-value wafer segments. SOI wafers are expected to lead revenue growth with a +7.9% CAGR, reflecting their expanding role in certain advanced device technologies. While industrial and automotive sectors are contributing more modestly, the transition to 300mm platforms is reinforcing long-term growth trajectories for leading-edge semiconductor applications.

Wafers at 300mm diameter, already the backbone of advanced device fabrication, are seeing usage encroach upon historically smaller diameter applications, both for cost efficiency and enablement of performance objectives. Epitaxial 300mm wafers are further enabling leading-edge logic and new packaging technologies, though suppliers face challenges in balancing capacity utilization with customer demand. Meanwhile, China’s government-backed push for self-sufficiency is driving its share of global wafer production capacity higher, creating growing competitive and pricing pressures worldwide. Smaller diameter wafers, including specialty products such as SiC, are under distress from softening demand and overcapacity, with further shakeout expected as production migrates to larger diameters. At the same time, international trade frictions, tariffs, and allegations of unfair business practices threaten to raise costs and compress margins across the wafer supply chain.