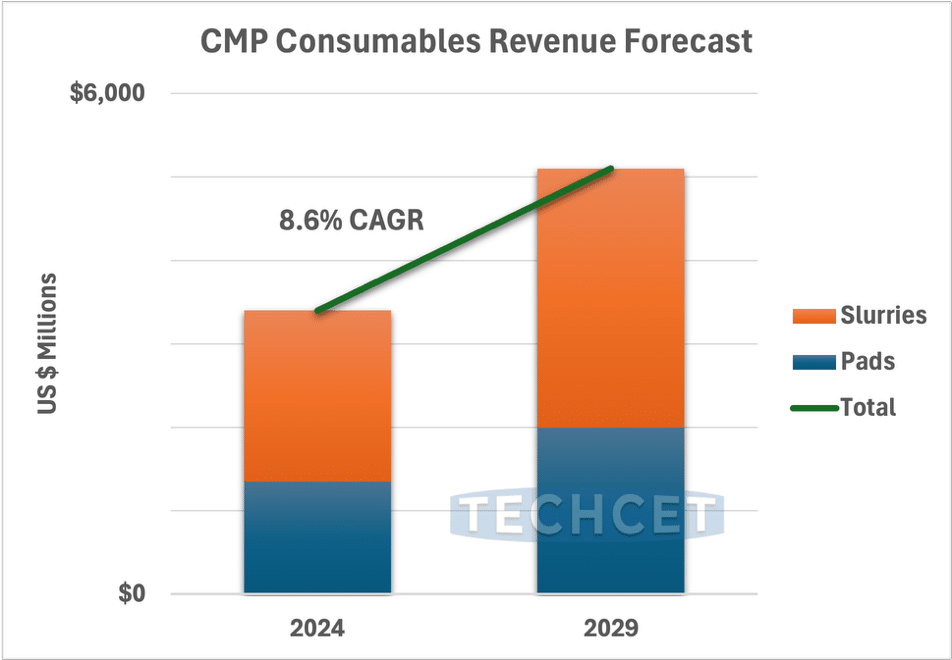

TECHCET forecasts nearly a 6% increase in CMP consumables revenue in 2025, reaching approximately US $3.6 billion, as semiconductor production continues its recovery and ramps up for advanced logic and memory devices. Looking further ahead, the CMP consumables market is projected to grow at an 8.6% CAGR through 2029. This growth is fueled by increased process steps driven by 3D NAND, gate-all-around (GAA) transistors, and backside power delivery, all of which require more frequent and specialized CMP steps according to TECHCET’s 2025 Critical Materials Report™ on CMP Consumables.

In 2024, the CMP consumables market showed modest growth of 1.6%, reaching an estimated US $3.4 billion. Slurry revenues increased just over 1% to US $2 billion, while pad revenues rose by 2% to US $1.39 billion. The growth was led by a recovery in DRAM production and the beginning of a rebound in advanced logic, though this was partially offset by flat demand in legacy technologies. Despite competitive pricing pressures, volumes held steady, particularly for oxide and copper-related applications. Emerging use of cobalt, ruthenium, and molybdenum also began to rise, though from a small base.

Moving forward, CMP process complexity will continue to increase as chipmakers scale to advanced nodes and adopt new packaging techniques such as 2.5D/3D integration and hybrid bonding. At the same time, environmental and safety concerns related to new metals are growing, prompting improvements in slurry formulations, tool ventilation, and waste handling. Geopolitical and trade issues, particularly regarding the sourcing of rare earth abrasives, will remain a key supply chain challenge, as suppliers work to diversify beyond China. As a result, CMP remains a critical enabler of semiconductor scaling and performance, and its global importance is only expected to rise.